Australia and China sealed a landmark trade deal hailed Monday as a "game-changer", abolishing tariffs in the lucrative resources and agricultural sectors as Canberra confronts a painful downturn in mining.

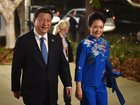

The pact, signed during a visit by Chinese President Xi Jinping, was lauded by Australian Prime Minister Tony Abbott as the first Beijing had reached with a major economy and "the most comprehensive agreement China has concluded with anyone".

Full Story

Full Story

Government revenues in Kuwait dropped 4.4 percent in the first half of the fiscal year due to sliding oil prices, but the energy-rich emirate still reported a healthy provisional surplus.

Official figures posted Sunday on the finance ministry website put April-September public income at 15.1 billion Kuwaiti dinars ($52.1 billion) compared with 15.8 billion dinars in the same year-ago period.

Full Story

Full Story

Qatar, host of the 2022 football World Cup, pledged Sunday to introduce new legislation to replace the controversial "kafala" sponsorship system and improve conditions for migrant workers by early 2015.

The current law, which limits the rights of movement for foreign workers, would make way for legislation that was "currently under review," said the labor and social affairs ministry.

Full Story

Full Story

Asian powerhouse China will host world leaders for the G20 summit in 2016, Australian Prime Minister Tony Abbott said on Sunday at the conclusion of two days of talks in Brisbane.

Turkey takes over the presidency from Australia and will host the event in Antalya next year, but in a communique the group of the world's biggest economies said China would be home to the G20 in 2016.

Full Story

Full Story

G20 leaders representing the bulk of the world's economy on Sunday committed to reform measures to lift their collective growth by an extra 2.1 percent by 2018, despite evidence of a slowdown in some major nations.

Full Story

Full Story

Iranian state television is reporting that the country has inaugurated a new gold-processing plant that will double the country's annual production to 6 tons.

The report says First Vice President Ishaq Jahangiri attended the inauguration Saturday of the plant near Takab in northwestern Iran.

Full Story

Full Story

As part of its efforts to develop professional and scientific activities to improve the pharmaceutical sector at all levels, the Lebanese Order of Pharmacists held its 22nd Annual Congress under the theme "Medication Safety in the Arab World" held along with the 29th scientific congress of the Arab Pharmacists Union under the patronage of HE the Prime Minister Mr. Tammam Salam represented by Minister of Labour Sejaan Azzi on October 24th, 25th, and 26th 2014 at the Hilton Habtoor, Beirut.

This was the declaration of Dr. Rabih Hassouneh, president of the Lebanese Order of Pharmacists, noting that the pharmacy conference and exhibition are considered one of the most eminent events in the pharmacy sector. The Order also endeavored to organize a well studied scientific program including all pharmacy specializations. The program included conferences focusing on the means of promoting drug safety in Lebanon and the Arab World, especially amidst the challenges facing the pharmacy profession as well as the continuous violations for which price is paid first and foremost by the Arab citizen whether in terms of health or cost. Moreover, conferences allocated to develop the technical and managerial skills of the pharmacists were presented by healthcare professionals coming from Europe and the Arab World. Multiple conference rooms were allotted for a period of three days to receive the audience of pharmacists.

Full Story

Full Story

Fitch ratings agency on Friday revised the outlook on Belgium from stable to negative, criticizing the country's efforts to tackle public debt.

The revision means the agency could in the medium term lower Belgium's "AA" credit rating, the third-highest level.

Full Story

Full Story

An initial deal between Iraq's autonomous Kurdish region and Baghdad aimed at resolving long-standing budget and oil disputes is "a very important first step," the United Nations said on Friday.

Baghdad has long opposed the three-province region's independent export of oil, while Kurdish leaders have criticized Baghdad for withholding budget payments to the region.

Full Story

Full Story

The OECD Friday forecast competition heating up among countries wanting to attract revenue from big digital companies like Apple and Google, even as a row rages over Luxembourg's arrangements with multinationals.

Closing corporate tax loopholes and endorsing a common reporting standard to increase transparency are set to be a primary focus of the G20 summit in Brisbane this weekend.

Full Story

Full Story